This article was first published on LinkedIn as part of the Signals over Noise newsletter.

Last month, BCG X and OpenAI published a joint report titled "Will AI Become the Best Car Sales Advisor?" It paints a compelling vision: Gen AI transforming car buying into effortless conversations, boosting OEM revenues by up to 20%, and creating seamless, personalized experiences that feel "as simple as talking to a friend."

The report argues that OEMs face severe customer dissatisfaction with the sales process and that Gen AI is an urgent, necessary solution. However, I believe the report inflates the scale of customer dissatisfaction and exaggerates the impact that Gen AI solutions—particularly those directly influenced or controlled by OEMs—can realistically have on sales outcomes.

The 48% Trick: How to Manufacture a Perception Crisis

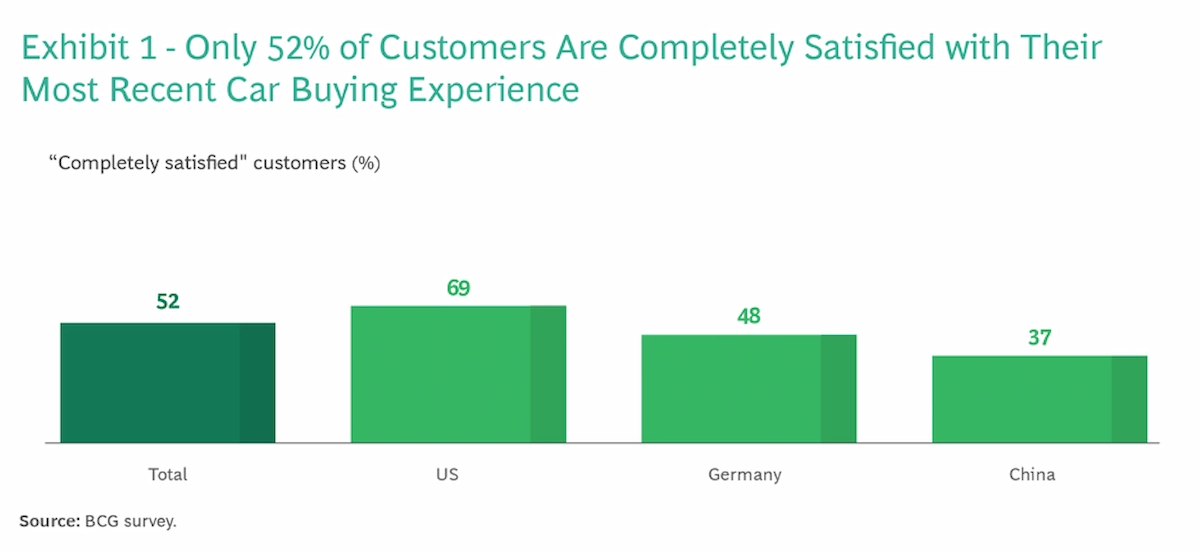

The report opens with a hook designed to create urgency:

"According to a recent BCG consumer survey, almost half of respondents who have recently purchased a car were dissatisfied with the experience."

Sounds alarming, until you read the actual research they're citing.

What BCG's data actually showed was that 52% of respondents were "completely satisfied" with their purchase experience (see the chart below). This means 48% were not completely satisfied, a category that surely should include everyone from "somewhat satisfied" through "neither satisfied nor dissatisfied", to genuinely dissatisfied customers.

By framing "not completely satisfied" as "dissatisfied," BCG manufactures a crisis that needs to be solved. It's the consulting equivalent of a mechanic pointing at your perfectly functional tire and saying, "You know, that's not completely inflated."

But the customer games don't stop there.

The Importance of Importance

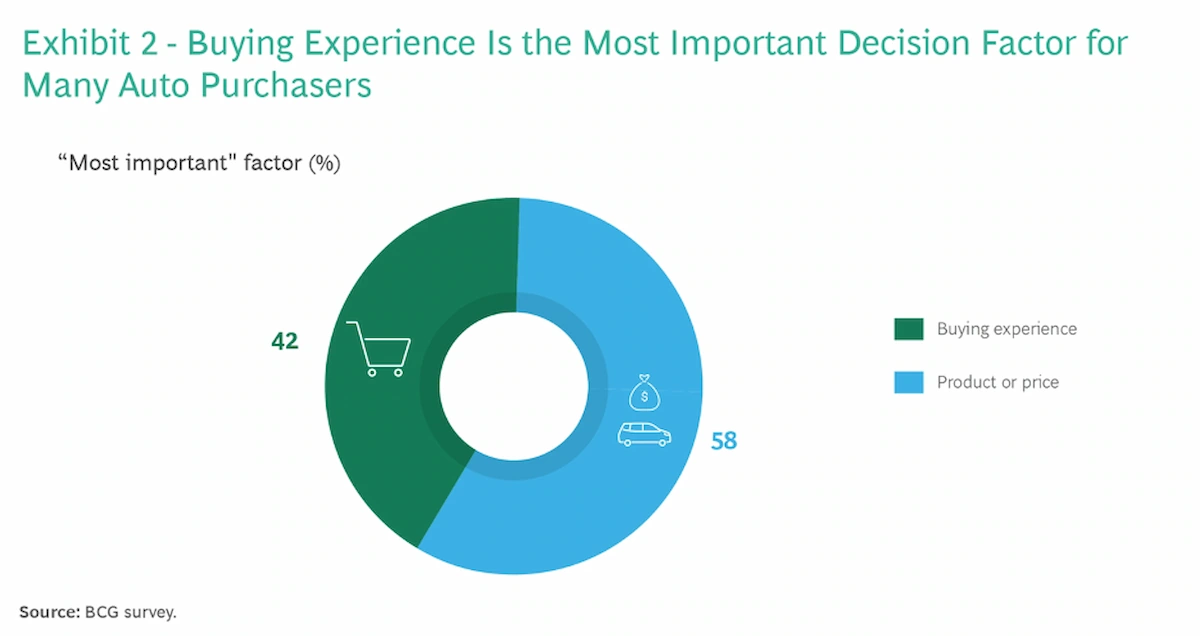

The same BCG research found that 42% of new car buyers said the purchasing experience was the most important factor in buying a new car, versus 58% who prioritized product or price:

I find this difficult to believe for any major region, but I'll focus on Southeast Asia, and Thailand in particular, as this is where I have the strongest data at hand.

The Auteneo dataset, and specifically the thousands of organic online discussions from car buyers (that is, people who are looking to buy a new car, not car owners or other users), show that 75% of discussions focus on product features and costs (price and other cost-related matters like running costs). Only 17% relate to the sales experience itself: things like dealer responsiveness, test drive availability, vehicle booking and waiting periods or the vehicle delivery experience. The remaining 8% of discussions relate to aftersales, something that was omitted in the BCG's chart.

Intuitively, as a customer, will I pay more attention to a sales experience that is relatively short, or to a product and price that I'll likely be using and paying for for years?

This isn't a minor discrepancy. It's a fundamentally different picture of what drives purchase decisions and how car companies should prioritize their resources based on "what customers say".

Real-world anecdotal evidence backs this up. Remember the overnight queues for the BYD Atto 3 launch in Thailand in 2022? People endured objectively terrible sales processes and spending hours overnight waiting for dealers to open, because the product and price made it worth the hassle in their view. Some could argue that those were early adopters of BEVs who are by definition a minority and not an "average buyer". True, but when recently GWM Tank 300's prices in Thailand were slashed after nearly two years on the market, sales jumped massively despite zero improvements to the dealer experience. When the product-price equation works, the vast majority of customers tolerate average sales experiences.

The Potential Math Problem

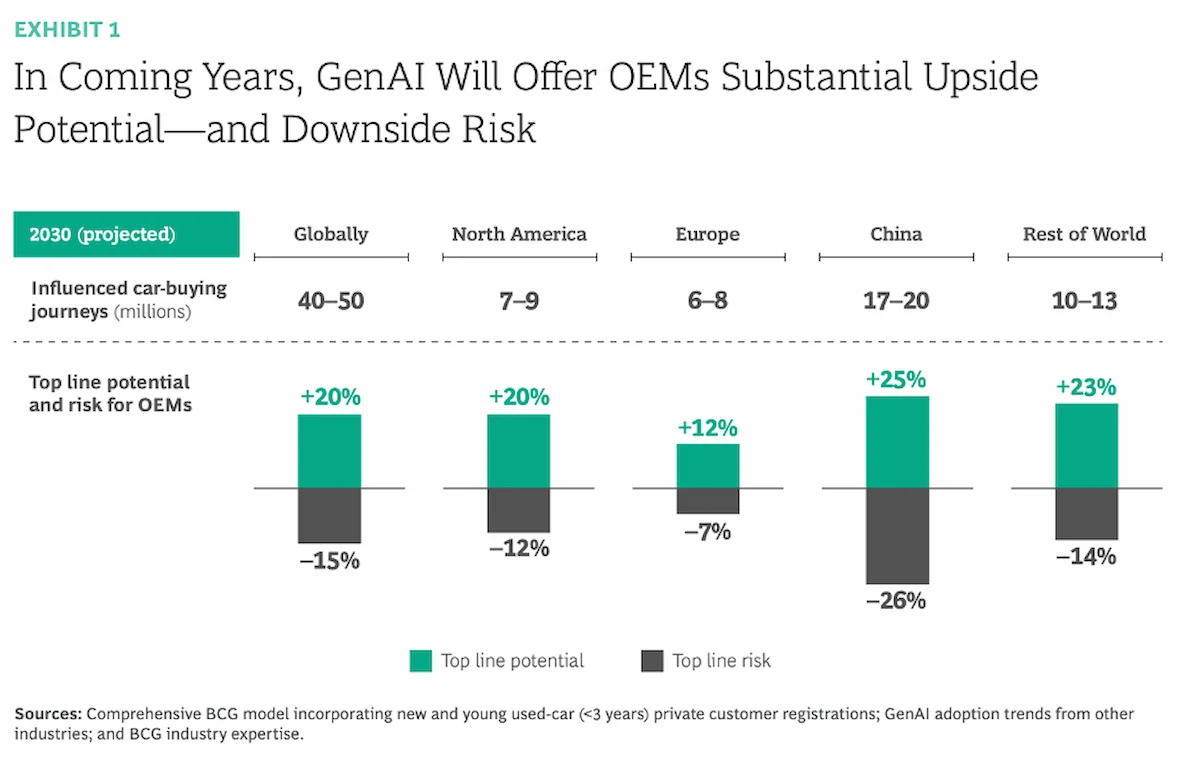

To further emphasize the urgency, the report says that Gen AI offers a topline upside potential of between 12–25% in extra revenues by 2030 depending on the region, and the downside potential of between 7–26% in revenue decline. The report links that impact to two main functions that Gen AI will play: product advisor and deal finder.

On the product advisor spectrum, the report devotes more attention to vehicle configuration complexity as a major pain point that Gen AI can solve:

"Some premium OEMs offer more than a billion unique configurations for a single car model. The broad variety of novel technologies, drivetrains, trims, and finishes... makes it nearly impossible for most consumers to fully understand their option space or configure their car optimally within their budget."

This is absolutely true. For Germany. For premium European brands where some customers spend hours in configurators agonizing over wheel styles, interior trims, and premium audio options.

But most car sales are not done this way.

As an example, most models in Southeast Asian markets like Thailand, Indonesia, or Malaysia come in 2-4 trim levels with minimal additional customization. You might choose an exterior color and perhaps an accessory package. That's it. The "billion configurations" problem simply doesn't exist here.

And the trend is moving further in that direction. Chinese brands—which are rapidly gaining share across Southeast Asia and other markets, including Europe—have embraced a simplicity playbook: fewer configurations, not more. The customer's main problem is which model to buy, not how to configure it.

What's intriguing are BCG's estimates regarding Gen AI's potential impact on OEMs' revenues. Let's think about the logic here: Gen AI supposedly helps customers configure cars better, which should matter most where configuration complexity is highest—that's Europe. Europe also has the highest brand loyalty, which should theoretically make upselling customers to better configurations easier, since they've already decided on the brand. Plus, it's in Europe where price discrepancies for the same vehicle model between dealers can be relatively high therefore giving an opportunity for new technologies to help customers find the best deal therefore eliminating that last friction. These factors should amplify Gen AI's impact, not diminish it. Yet BCG projects the smallest Gen AI impact in the region where their own logic mostly indicates it should matter most.

Meanwhile, markets like Southeast Asia (part of the "Rest of World" in BCG's chart) which have minimal configuration options and lower brand loyalty somehow might face the biggest potential disruption from a tool that mainly helps with configuration complexity and finding the best deal? Perhaps BCG has more arguments for that but they are not in the report.

The Elephant in the Room: A Solution in Search of a Problem?

Let's address the authors: this is a joint report from BCG X (BCG's tech arm) and OpenAI. This isn't just a detail; it's the lens through which the entire report should be viewed.

OpenAI’s goal is, quite naturally, to promote its technology. For them, it's a marketing document as much as a research paper, and there's nothing wrong with that.

The more significant issue is BCG's role. A consultant's primary value is supposed to be objective, vendor-agnostic advice. This is especially critical with a technology as new as Gen AI. Different Large Language Models have different levels of accuracy, speed, cost, and security among other variables. Guiding a client through these trade-offs should be a core element of any Gen AI project.

By co-authoring a report with a specific AI provider, BCG's objectivity is thrown into question, which should raise questions for any OEM. If an OEM would like to build a Gen AI advisor with BCG, does it mean that they would have to use an OpenAI's model? And if not, why co-publish this report with OpenAI in the first place while calling all analysis in the report "BCG analysis"?

This approach risks turning what should be strategic advice into a sales pitch for a pre-selected solution, leaving clients to wonder whose interests are truly being served.

The Brand Safety Dilemma

In discussing how OEMs should ensure visibility in third-party AI assistants such as a ChatGPT chatbot, the report states:

"Brand safety is a crucial concern. Gen AI models draw their information from all kinds of sources, including reviews on social media platforms and other outlets that can be misleading, inaccurate, or even intentionally disparaging. OEMs will need to work with providers of LLMs to monitor and improve the accuracy of their models' answers."

Let's read that carefully.

On the surface, it sounds reasonable. Who wouldn't want to correct factual inaccuracies about their products? However, it opens up a complex new area for the industry, raising important questions about the line between ensuring accuracy and influencing narrative.

The critical question is what this process looks like. Is it about correcting objective errors, or does it become a negotiation over which owner reviews and public forums are considered "accurate"?

This is where the report's co-authorship becomes so relevant. With ChatGPT being the dominant consumer AI, the advice to "work with LLM providers" creates a powerful incentive for OEMs to engage directly with OpenAI. It reframes brand safety from a PR task into a strategic relationship with a new, powerful gatekeeper of public information.

The Neutrality Paradox

The report describes the role of AI as that of a trusted advisor that will provide consumers with unbiased, comprehensive advice, while having brands actively shaping what AI knows and says about them.

You can't have it both ways. An advisor is either objective or it isn't. It either draws from the full, messy spectrum of public information—including the angry owner on Facebook or the detailed forum post on build quality—or it delivers a sanitized version filtered through "brand safety" partnerships.

This conflict plays out in two other scenarios the report proposes to OEMs:

- Third-party marketplaces. The report itself acknowledges the tension, telling the third-party platforms how "they must figure out how to balance maintaining their perceived independence as a trusted, objective advisor" while taking OEM money. It even warns that e-commerce platforms lost credibility when they tilted too far toward sponsored placements. The outcome seems inevitable; the only question is how long the illusion of neutrality can last.

- OEM-branded assistants. Here, the pretense of neutrality is dropped. Will a Toyota AI ever recommend a Honda? Of course not. The report calls this a tool to "upsell them to more profitable car configurations." This isn't advice; it's sales optimization.

Ultimately, the customer isn't a fool. They will quickly learn who the AI truly works for. And in that moment, the enormous investment in building an "AI advisor" won't have built trust; it will have created a new, more sophisticated way to destroy it.

The Actual Customer Pain Points

The report’s central theses—that Gen AI is needed to simplify complex vehicle configurations or to find the best price for a car configuration and complete the buying process in the tool—miss the mark for most buyers in Southeast Asia. If there is meaningful friction to discuss, it is in areas such as:

- What are the most common issues with this model, and does the brand fix them?

- What is the real-world fuel/energy consumption and cost?

- What to check for during vehicle delivery?

- Will the dealer push back the delivery date?

- What will the vehicle price be next month?

- What will this car actually be worth in three years?

These are questions of trust and certainty. And critically, they are questions that can only be answered by real-world data from other users or by fortune tellers (😊), not by an OEM's sanitized product information fed into a chatbot.

Another Take on AI Playbook

So, what should OEMs do? The report offers three grand strategic priorities. Here’s my own grounded take on each.

1. On Third-Party Assistants like ChatGPT: Audit, Don't Collaborate

Instead of rushing into "brand safety" partnerships with LLM providers, start by becoming a "secret shopper". Task your team to regularly audit the major AI chatbots.

Ask simple questions: "What is the ground clearance of the [Your Model]?" Does it give the correct, localized spec? Ask broader questions: "Recommend a cost-efficient SUV with a large interior." Does it even mention your relevant model? Does it get the name right, or does it use one from another market?

If you find inaccuracies, especially ones that affect you but not your competitors, investigate the public data sources driving those errors. This is a low-cost, defensive strategy focused on monitoring and understanding that should help you better assess whether you're facing any risks or challenges.

2. On OEM-Branded Assistants: Prototype for Learning, Not for Launch

The report's vision of an all-knowing, perfectly-working and neutral branded assistant is a money pit with questionable ROI. The cost to build and localize it for every key market is very significant, not because of technology, but because testing and evaluating it in various scenarios is a labor-intensive effort.

Then there’s the aspect of the technology itself. Imagine Japanese automakers, whose culture is built on eliminating every last bit of uncertainty, trying to manage the inherently unpredictable nature of LLMs. The risk of a brand-sanctioned AI giving a wrong or "creative" answer is a quality control nightmare.

The smarter play? Create a small, in-house team to prototype a limited version. The goal is not a customer-facing product, but to build internal knowledge and capabilities. Have someone who understands LLMs' strengths, weaknesses, knows how to implement tools like Retrieval-Augmented Generation (RAG) when needed. Keep the learnings in-house, not with a consultant.

3. On Third-Party Marketplaces: They Should Stay Independent

Here, my advice is for the marketplaces themselves: don't risk damaging your trust by partnering with OEMs.

I believe that if there is any significant opportunity to leverage Gen AI as a sales advisor, it must be through truly independent, customer-obsessed third-party marketplace. This means:

- Solving real friction points: Go beyond OEM data. Use AI to summarize thousands of owner reviews, calculate real-world running costs, show the likelihood of receiving car financing, and model residual value projections.

- Finding a new business model: Monetize without compromising neutrality. Offer sponsored placements for dealers (not brands), take referral fees for used car trade-ins, and offer ad space.

This is the most likely path to creating real, sustained value for the customer. It's a hard path, and the ROI is not guaranteed, but at least it’s a vision built on trust, not a sales funnel.

Closing Thoughts

The BCG and OpenAI report presents a compelling, top-down vision of an AI-driven future. But real progress rarely starts with a technology in search of a problem. It begins with a deep understanding of the customer's actual pain points.

For too long, the automotive industry has made significant decisions based on customer surveys, a methodology that has repeatedly proven to be a poor predictor of real-world behavior. The most critical challenges for customers aren't found in the tidy statistics of a questionnaire. They are in the lived experience of buying and owning a car: the unreliable delivery timelines, the true cost of ownership, and the gap between a promise made at the sale and the reality years later.

This is where the true, immediate power of AI lies for automakers. Not in building a better salesperson, but in building a far better listener. Before investing millions in an AI advisor, companies should first use AI to become better students of their customers' reality. Understand the problem from their perspective. Only then should they build the solution.