For decades, the formula for a premium European automobile was largely the same. It was a potent combination of tangible product quality and innovation with emotional aspiration. A buyer chose a premium European brand both for its superior engineering and for what it represented: financial success, sophisticated taste, and a sense of belonging to an exclusive social stratum— a status particularly valued in Southeast Asia. This value proposition was so powerful that premium brands not only weathered the challenges of the Covid-19 pandemic but even increased their sales.

But the foundations on which premium brands have long relied are now shifting. The dawn of the EV era, coupled with the decision by these brands to pursue multiple powertrain options simultaneously, has led to a profound conundrum. This challenge is arguably even more pronounced in Southeast Asia than in Europe.

Challenge #1: The Inversion of Spec-Based Leadership

The first and most jarring challenge is the erosion of their established product leadership. For decades, premium brands led the pack. Today, new leaders have emerged.

For instance, new, digital-native competitors have made major leaps in infotainment and software, unlocking a world of new entertainment options and other features, at significantly lower price points.

On the hardware side, BEV technology has allowed new players to surpass the ICE powertrains of legacy brands on key performance metrics such as horsepower and 0-100 km/h acceleration. Even within the BEV space, legacy players are finding it not easy to keep pace, let alone surpass, newer brands on battery range and energy efficiency.

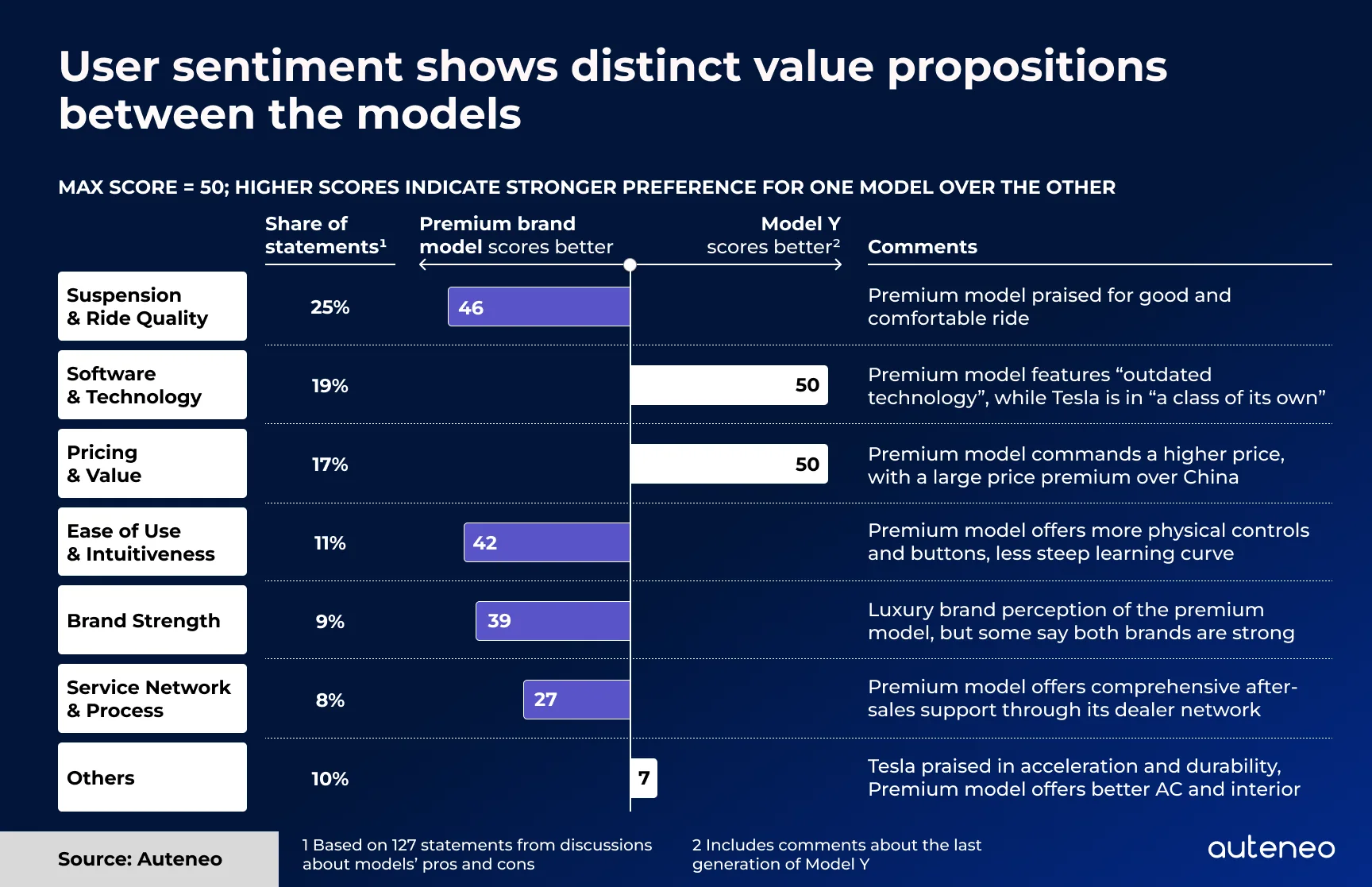

Our analysis of customer sentiment in Thailand from January to September 2025, comparing two BEV SUV models—one from a legacy premium brand introduced in late 2021 and the other from Tesla—clearly illustrates this gap and confirms customer awareness.

Figure 1

The gaps in battery technology (range, performance) and software (reliability, feature set) are glaringly obvious to online users. This is particularly visible for the legacy model, which has been on the market for several years. In contrast, Tesla has continuously improved the user experience through over-the-air updates and launched a new model generation this year, resulting in a wide perceived gap.

Challenge #2: Widening Price Gap and Price Transparency

The second challenge strikes at the core of the premium business model: pricing. A premium price is not just a reflection of cost; it's a feature. High prices signal exclusivity, reinforce desirability, and affirm the buyer's status. By this logic, a brand like BMW should maintain its high prices to protect the very brand equity it has spent decades building.

However, as product leadership erodes, the justification for a premium price tag is coming under more intense scrutiny by some prospective buyers, a situation perfectly captured by one online commenter in Thailand regarding the premium SUV from a legacy brand:

"An electric car with no import tax sold at gasoline car prices just for brand image."

Consider the price difference for the same vehicle, built in the same Chinese factory, sold in two different markets. A premium brand's BEV in China, after discounts, costs the equivalent of less than US$ 35,000. In Thailand, the dealer price after discounts is over US$75,000—a premium of over 100%. By contrast, BEVs from newer brands typically command a far more modest 35-45% premium in Thailand over China.

In the past, steep import tariffs on cars from Europe provided a good justification for the price difference. Today, with a 0% import tariff on BEVs from China, if premium brands decide to export their vehicles from China, that excuse is gone. The internet and artificial intelligence grant consumers unprecedented transparency, allowing them to easily compare regional pricing and ask a difficult question: why should a customer in Thailand pay double for almost the same car?

This erosion of price justification is challenging the perceived fairness of premium pricing and is already causing some customers to choose other brands, including new Chinese entrants. Some Chinese brands have enjoyed considerable success in the large MPV segment, which is perceived as premium in its own right. Here, they offer large, comfortable vehicles with luxurious interiors for prices similar to mid-level premium segments, successfully converting shoppers who were considering sedans or SUVs from European brands.

Challenge #3: The Strategic Balancing Act

The final challenge is an internal one, stemming from a fundamental strategic conflict. Unlike their BEV-native competitors who have a singular focus, legacy brands are straddling two worlds. They must continue to invest in and sell their traditional—and often more profitable—ICE vehicles while simultaneously developing a completely separate lineup of BEVs, which frequently require different platforms and supply chains.

This creates a classic innovator's dilemma. Every BEV sold, particularly at a competitive price point, risks cannibalizing a higher-margin ICE sale. This forces brands into a delicate balancing act: pushing hard enough into the EV market to remain relevant, but not so hard that they prematurely decrease the profitability of their core business.

This internal conflict is amplified by external market forces like taxation. In markets such as Thailand, favorable tariffs for BEVs (especially from China) and high taxes on traditional ICE vehicles create an uneven playing field within a brand's own portfolio. Reducing the prices of their new electric models can decrease ICE sales and and also erode the brand equity over time.

What's Next? The Path Forward for Premium Brands

The challenges are formidable, but the path forward is not to abandon the core principles of a premium brand, but to redefine how they are delivered in the EV era. The overarching goal is simple: deliver more tangible and emotional value to the customer. This requires a three-pronged strategy.

Improve the Spec Sheet but Don't Overestimate It. While narrowing the technology gap in battery range and software is non-negotiable, winning a feature-for-feature arms race is a losing game. Simply adding few extra kilowatt-hours to the battery to extend range may help on paper, but it is unlikely to be a strong differentiator in. a market where long range is becoming the norm already. Instead, a better approach may be to make EV technology and software good enough that customers do not see major gaps over the competition.

Amplify the Advantages. Premium brands must double down on their strengths—the areas where new competitors often fall behind. While new entrants talk about infotainment and acceleration, legacy brands can highlight the superior ride quality from decades of suspension tuning, the peace of mind offered by an extensive and reliable service network, or the tactile quality of a meticulously crafted interior. As shown earlier in the user sentiment chart (Figure 1), these are the attributes that consumers identify online as those where premium brands hold an advantage.

To make the most of their advantages, brands will require more sophisticated marketing and communications approaches. First, brands must better understand not only the Voice of their Customer (VoC) but also that of their competitors, including the Chinese brands. By understanding why buyers choose—or reject—their vehicles and those of their rivals, brands can adapt their messaging. This intelligence is crucial, as the next major competitor may not be a straightforward one, as demonstrated by the rise of feature-packed MPVs and the Tesla Model Y.

Brands will also need to adjust how they utilize influencers. Our analysis for a premium legacy brand revealed a significant disconnect between what influencers focus on and what customers praise. This is unsurprising, as influencers are often more accustomed to new technologies and focus on short-term product reviews rather than the long-term ownership experience. To better amplify their advantages, brands may need to encourage new review formats that highlight these strengths.

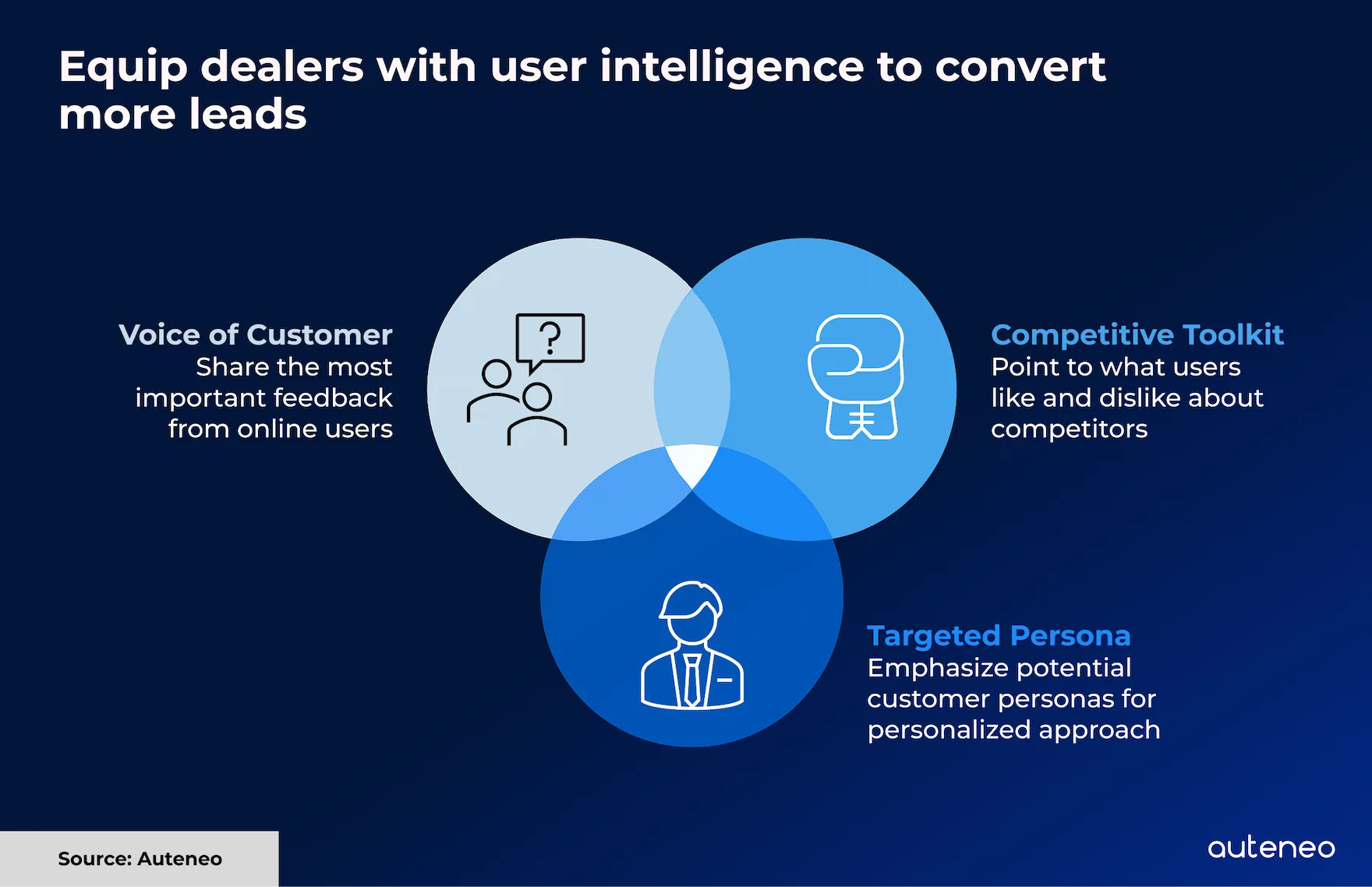

Equip the Front Line. The battle for premium value is often won or lost on the showroom floor. In an era where customers arrive armed with online research, sales teams can no longer be mere product presenters. They must become strategic advisors, and this requires equipping them with a new weapon: user intelligence.

Figure 2

This means transforming the traditional sales kit into a dynamic, data-driven toolkit built on three pillars:

The Voice of the Customer (VoC): Instead of relying on generic marketing copy, salespeople should be armed with the most important feedback from actual users—what they love, what frustrates them, and what they praise as standout features. This allows them to speak with the authenticity of the market itself.

A Competitive Toolkit: This goes beyond spec sheets. It means pointing to what real users like and dislike about key competitors. By knowing about user discussions on comparison points, the sales team can sharpen their counter-arguments and confidently address the strengths and weaknesses of rivals.

Targeted Personas: This intelligence must be personalized. By understanding the different customer personas—the tech enthusiast, the comfort-seeker, the status-conscious buyer—salespeople can tailor their approach, emphasizing the specific brand advantages that will resonate most with the individual in front of them.

Crucially, this is not a one-time training session; it is a continuous intelligence cycle. Brands must actively track emerging customer feedback to stay ahead. This involves monitoring conversations around their own models to understand sentiment shifts, while also scanning for new threats by analyzing early reviews of emerging models. By spotting competitors' weaknesses before they gain traction, brands can constantly update their sales playbook.

A Final Warning: The Danger of Complacency

Ultimately, the greatest threat is complacency. Premium brands can no longer assume that the power of their badge alone will bring customers to their showrooms. Some loyalists will certainly remain, but brands must not fall victim to the confirmation bias of listening only to them. The real story lies with the customers who never walk through the door. Those who perceive a value gap are not waiting to be convinced—they are quietly converting into buyers for other brands. The fight for the future of premium is on, and it must be won with every single customer, every single time.

Want to learn more about our powerful intelligence platform?

Click here.