Public EV charging has long suffered from the chicken-and-egg dilemma: drivers won’t buy EVs without convenient charging, and investors won’t build charging stations without enough EVs on the road. Thailand is now breaking this stalemate. It is the regional leader in EV adoption in Southeast Asia. To date, more than 225,000 fully electric four-wheeled vehicles have been purchased in Thailand. While this still represents less than 2% of the overall four-wheeled vehicle fleet, it is a large enough base to reveal what works and what doesn’t. These insights can guide future investment in Thailand and provide lessons for peers across the region.

Approach to Data

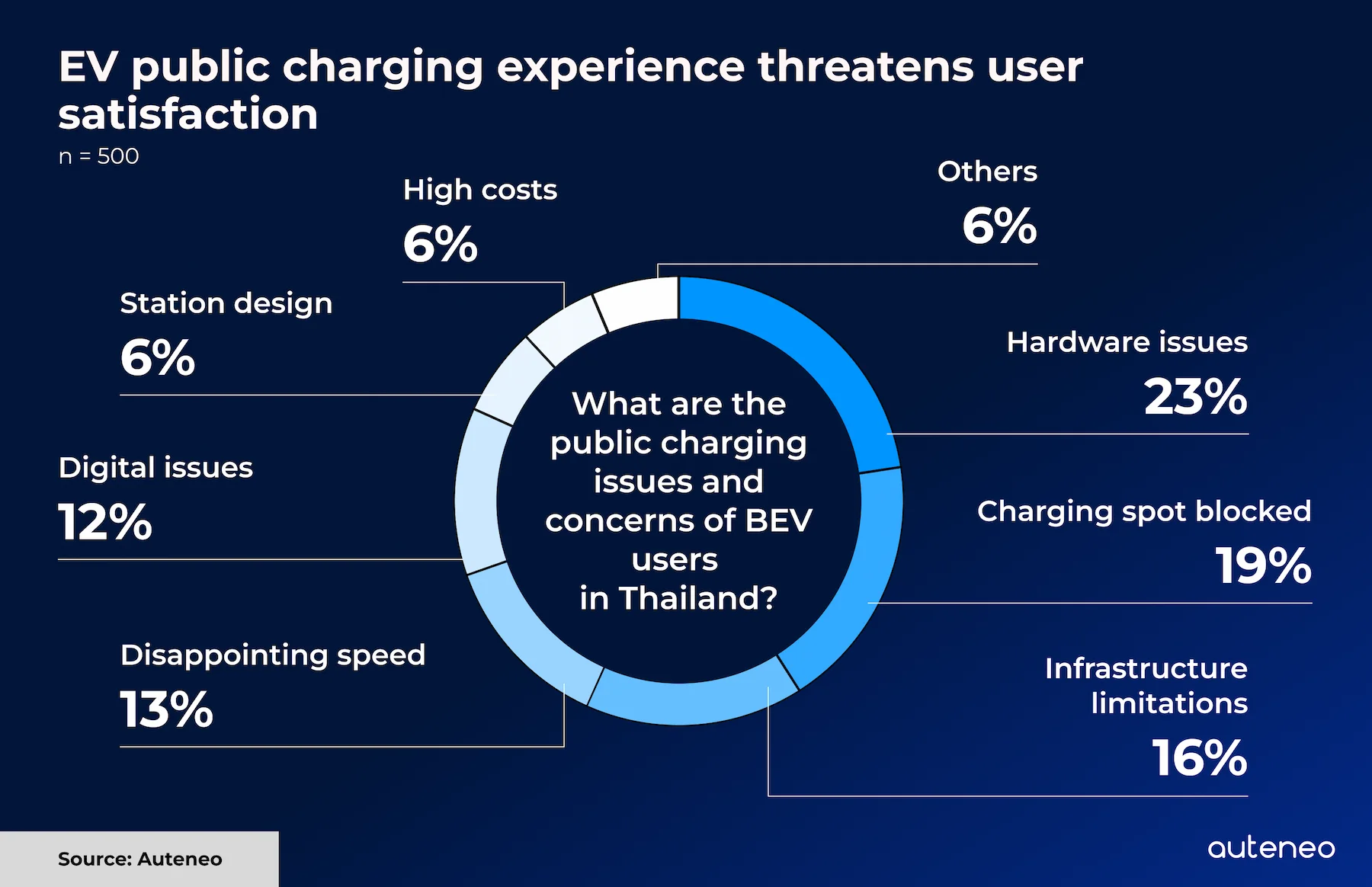

Our findings are based on publicly available data. We collect and analyze scattered online conversations, which Auteneo turns into strategic clarity for the automotive industry. For this study, we randomly selected and analyzed 500 negative statements related to public EV charging in Thailand.

Hardware and Access Issues Dominate Complaints

- Hardware Reliability Issues (23%): This is the single biggest source of frustration. General complaints about failed connections, interrupted sessions, and chargers being completely offline are common. More specific and concerning issues include cables that get stuck in the vehicle’s charging port, sometimes requiring a technician to release them. Users also report faulty charging heads that won't detach, and in some extreme cases, even melted charging pins—a significant safety concern. Compatibility mismatches, where a user fails to recognize a specific vehicle model, also feature prominently.

- Charging Spots Blocked (19%): This includes "ICEing" (an internal combustion engine vehicle parking in an EV spot), fully charged EVs left plugged in, and other physical obstructions. This is a problem linked not only to inconsiderate behavior but also to digital systems, such as booking apps where a user expects an available spot but finds it physically blocked upon arrival.

- Infrastructure Limitations (16%): Not enough stations overall, or all stations being occupied, especially during peak times like public holidays or weekends. Users also point to an uneven distribution of chargers between neighborhoods and along key travel corridors.

- Disappointing Speed (13%): Actual charging power is often below what users expected from signage or app listings, including throttling at shared sites. While some of these issues stem from local electricity capacity constraints, others might be related to vehicle limitations, such as the battery overheating and reducing its charge rate. However, this is often difficult for the user to determine the exact cause.

- Digital Issues (12%): Unscannable QR codes, unstable apps, account and login friction, poor mobile connectivity at the station, confusing user interfaces, and payment failures are frequent complaints.

- Station Design (6%): Practical design flaws cause daily friction. Common complaints include charging cables that are too short or heavy, tight parking bays that are difficult to access, and a lack of rain protection.

- High Costs (6%): Per-kWh or per-minute pricing is sometimes seen as too high, especially when the charging speed under-delivers. Some customers also perceive significant energy loss during the charging process, making the final cost feel inflated.

- Other Concerns and Issues (6%): This category includes aggressive or confrontational behavior around queues, general safety concerns when handling high-powered equipment, and the overall inconvenience of trip planning due to "charging anxiety"—the fear of not finding a functional charger when needed.

What It Means

These issues are not just concerns for current EV owners whose experience is suboptimal. These public complaints can influence potential buyers, who may delay their own EV purchases and opt for other powertrains instead.

This presents a dual challenge for auto companies and charging players:

- Auto Companies: Negative charging experiences can slow vehicle sales and damage brand perception, especially if a particular car model is seen as having compatibility issues.

- Charging Players: In this early but rapidly growing market, reputations are being shaped. Suboptimal service can quickly steer customers—and their future revenue—toward more reliable competitors.

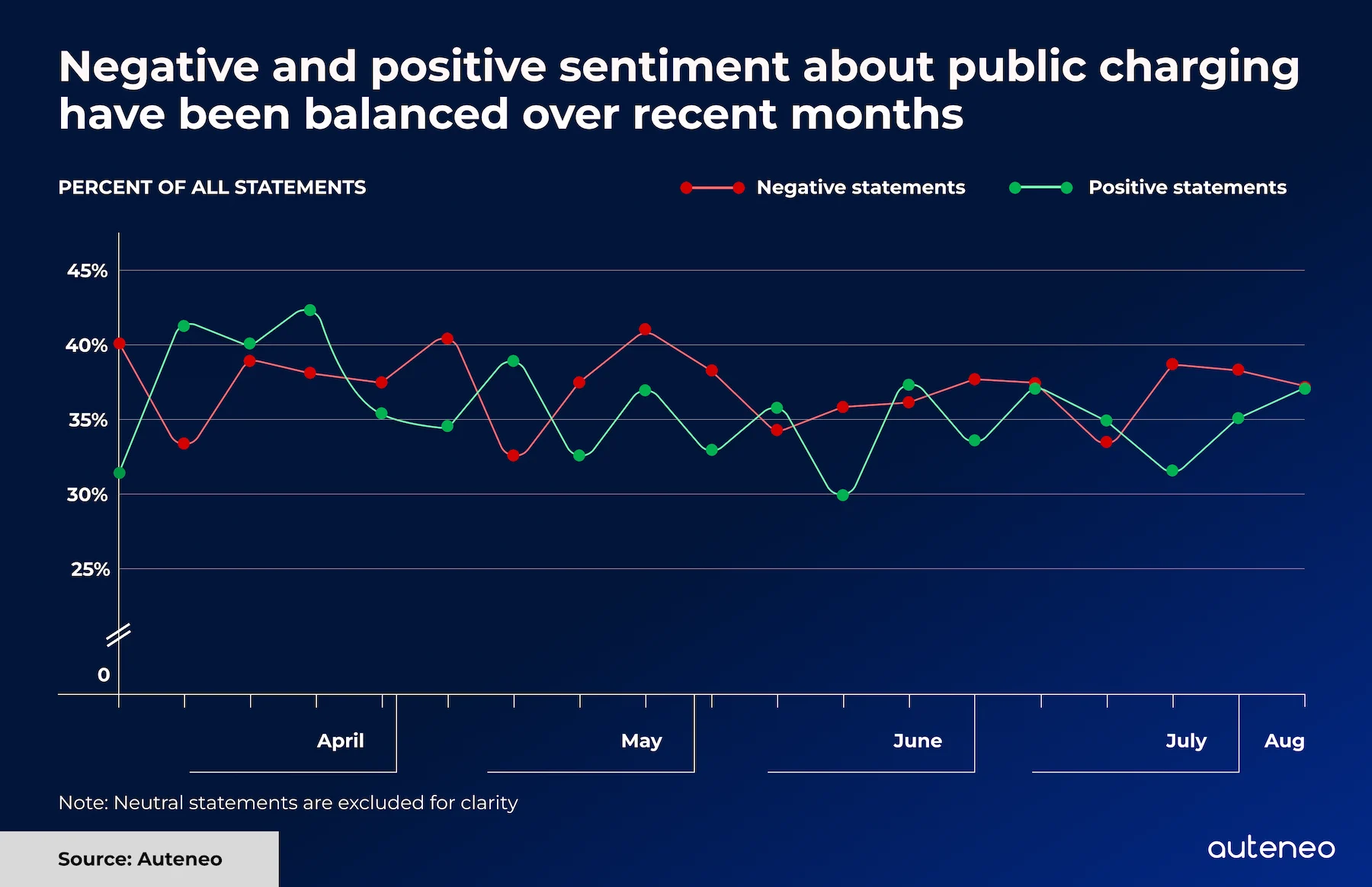

It's Not All Bad

Despite these issues, there are many positive statements about public EV charging in Thailand. In fact, when looking through a broader lens, the share of negative and positive statements is quite similar. This indicates that there are no widespread, critical failures undermining the entire system. The impact of charging availability on the decision to buy a fully electric vehicle should not be overstated, though it almost certainly varies by geography. The need for more infrastructure is greater in certain provinces, a factor we will aim to quantify in future research.

Ultimately, even when taking into the account positive statements, charge point operators (CPOs) must focus on addressing core concerns and issues to win customer loyalty.

Final Words

Thailand has made a strong start, but it is still early in the journey of building out its EV charging infrastructure. Customers clearly expect better service: both at the station and on the screen. The winners in this space will be those who treat charging as a complete system, not just a stack of boxes. This means integrating reliable hardware, accurate data, intuitive apps, fair usage policies, and responsive human support.

Get those basics right, and Thailand won’t just lead Southeast Asia in EV adoption. It will set the regional benchmark for the entire EV user experience.

Want to learn more about our powerful intelligence platform?

Click here.