For decades, the Internal Combustion Engine (ICE) pickup truck has been the undisputed king of the road in Thailand. But a seismic shift is underway, rapidly redrawing the country's automotive landscape. New data reveals the pickup's market share is in a steep decline, partly at the cost of an unlikely replacement—non-pickup Battery Electric Vehicles (BEVs) that are proving to be good enough for former truck owners.

A Market in Flux: The ICE Pickup's Decline

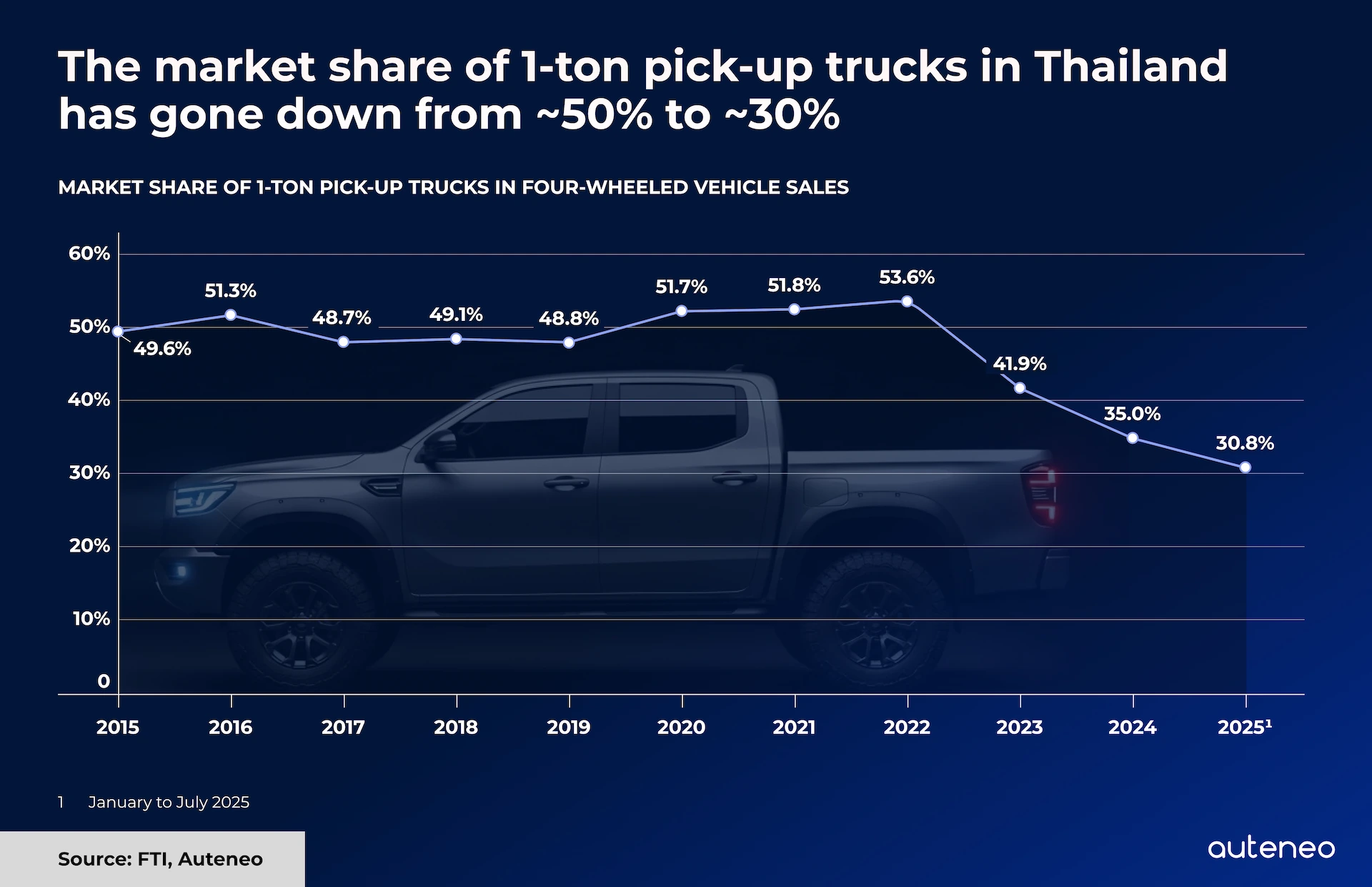

The numbers are stark. The market share of traditional ICE pickup trucks in Thailand has plummeted from a steady ~50% between 2015 and 2022 to just 30.8% in the first seven months of 2025. While many insiders point to tightening finances and stricter auto loans as a primary cause, that isn’t the full story.

Simultaneously, BEV adoption is surging, reaching an 18% market share in the first 7 months of 2025—a massive leap from just 1% in 2022. This growth is nationwide, with 35 provinces now recording over 10% BEV market share. Online conversations confirm a direct link: some buyers are abandoning ICE pickups for non-pickup BEVs. The single most powerful driver is the potential for substantial fuel cost savings. Users who once spent 4,000-5,000 baht a month on fuel now report saving thousands. One owner’s long-distance trip cost 2,000 baht in electricity; the same journey, in their old pickup, cost over 4,000 baht in fuel. This economic argument is so persuasive that it’s overriding traditional preferences, proving that for some, the utility of an electric sedan or SUV is a perfectly adequate—and far cheaper—substitute for a truck bed they rarely used.

The Electric Contender: Hopes and Hurdles for the New BEV Pickup

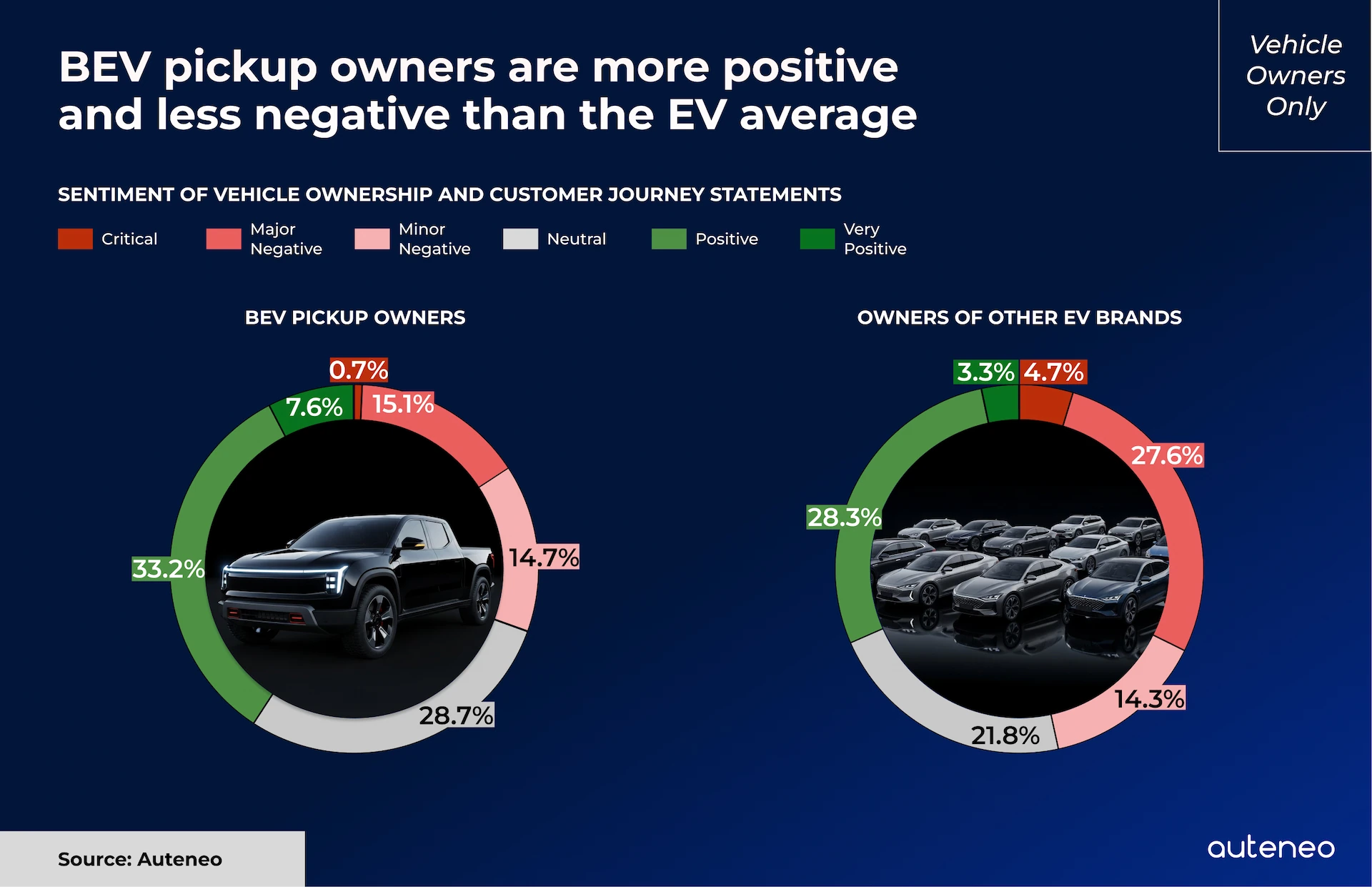

While non-pickup BEVs are capturing former truck owners, a dedicated BEV pickup segment is also emerging. To understand its potential, we analyzed over 3,500 online statements from early adopters in 2025. These conversations reveal a vehicle class defined by its incredible promise and significant frustrations.

The promise of the BEV pickup is rooted in its raw capability and revolutionary economics. Skeptics who dismissed them as "city trucks" are being proven wrong by users who document towing 3-ton trailers up steep mountains and commercially hauling heavy loads with superior stability, thanks to the high torque of electric motors. The economic argument is even more compelling. Owners report monthly fuel bills plummeting from 12,000 baht (diesel) to just 4,000 baht (electricity), and per-kilometer towing costs falling from 4 baht to just 0.90 baht. Furthermore, unique features like Vehicle-to-Load (V2L) are redefining utility, allowing trucks to function as mobile power banks for work sites or events, while the ability to run air conditioning overnight cheaply offers unmatched comfort.

Despite this potential, the real-world ownership experience is not without its frustrations. Our analysis from social listening shows that while BEV pickup owners are more positive (41%) than the average EV owner, a significant portion of feedback is negative (31%). The complaints center on a lack of refinement. The absence of Apple CarPlay and Android Auto is a universal grievance, compounded by laggy touchscreens and a low-quality rear-view camera. Owners also criticize the harsh, cheap factory-equipped tires, noting that a simple swap transforms the ride comfort. Beyond quality issues, the high initial purchase price remains a significant barrier to entry, placing the vehicle out of reach for many commercial buyers who see it as a work tool. This has fueled overwhelming demand for simpler, more affordable single-cab or space-cab versions—a core market segment the current four-door models fail to address.

The Path Forward: Who Will Claim the Crown?

The throne once occupied by the ICE pickup is open for grabs. For any brand aspiring to wear the new crown, the path forward is being written in real time through social media and online conversations. So far, these conversations point to three critical fronts that will determine success:

- Master the Fundamentals of Trust and Quality. A powerful motor is not enough. Brands must invest in robust after-sales service and fix frustrating issues like the lack of modern infotainment and subpar components. In a market nervous about new technology, trust is the most valuable long-term currency.

- Weaponize the Economic Revolution. The most powerful marketing will be about hard numbers—the monthly savings on fuel and maintenance. Brands must frame their vehicle not as a purchase, but as a financial investment that pays daily dividends.

- Target the Entire Volume Market. The pleas for single-cab and space-cab BEVs point to a crucial strategic gap. The first brand to deliver a dedicated, affordable electric workhorse will unlock a vital commercial segment.

The era of the pickup’s undisputed dominance is over. The market is fracturing into a new three-way race. Non-pickup BEVs are annexing territory from owners prioritizing cost savings. New BEV pickups are poised to conquer daily commerce with their low running costs—especially for owners who can rely primarily on home or workplace charging, as public charging networks remain far from perfect. This leaves the traditional diesel workhorse to defend its heartland of demanding, long-haul journeys. The brands that dominate the next decade won't be the ones with the loudest marketing, but the ones that listen most carefully to customer needs.

Want to learn more about our powerful intelligence platform?

Click here.